As investors, we always search for markets that deliver a balance of safety, income, and long-term growth. In 2026, Investing in Dubai continues to stand out because the city combines strong regulations, global demand, and future-ready infrastructure. For example, Sobha Real Estate is one of the leading names contributing to this mature and transparent market.

Dubai has moved far beyond being a speculative market. Today, it offers transparency, predictable growth, and a mature real estate ecosystem that supports serious investors.

Within this environment, Sobha Realty has earned a reputation for quality-driven development and disciplined execution. When we invest in Sobha Real Estate, we are not chasing hype. We are choosing assets that focus on construction quality, long-term livability, and consistent performance.

These factors matter because they directly affect rental income, maintenance costs, and resale value.

Key Takeaways

- Investing in Dubai stands out in 2026 due to strong regulations, global demand, and future-ready infrastructure, particularly with Sobha Real Estate.

- Sobha Real Estate focuses on quality construction, offering stable rental income and lower maintenance costs, which attract long-term investors.

- Key Sobha developments in Dubai include Sobha Hartland II, Sobha One, Sobha Orbis, and Sobha Verde, each catering to different investment strategies and tenant demands.

- Understanding financing options, legal considerations, and effective property management are vital for maximizing ROI in Dubai’s real estate market.

- Overall, areas like Jumeirah Lake Towers and Mohammed Bin Rashid City present solid opportunities, supporting long-term capital appreciation.

Sobha Real Estate (Dubai): Background and Reputation

From an investor’s standpoint, the developer behind a project matters as much as the location itself. Sobha Real Estate has built its brand on a unique backward-integrated business model.

The company manages design, engineering, construction, and quality control in-house. This level of control reduces dependency on third parties and minimises execution risks.

For investors, this approach delivers real benefits. Projects complete on time more often. Construction quality remains consistent across phases. Materials, finishes, and workmanship age better over the years.

This directly lowers long-term maintenance costs and improves tenant satisfaction. As investors holding assets for several years, we see this as a strong advantage.

Sobha’s reputation also attracts a specific tenant profile. Professionals, families, and corporate renters prefer well-built homes with reliable maintenance standards.

This demand supports stable occupancy and reduces rental volatility. In a city with many developers, Sobha’s disciplined execution gives investors confidence that their capital sits in assets designed for durability, not shortcuts.

Sobha Real Estate Developments in Dubai to Consider in 2026

When analyzing Sobha Real Estate developments as part of Investing in Dubai, we focus on three core factors: rental demand, future infrastructure growth, and resale liquidity. In 2026, several locations align well with these investor priorities.

Each of these areas supports a different investment strategy. Some favor yield-focused investors, while others appeal to those targeting long-term appreciation. A diversified portfolio often includes more than one of these locations.

Sobha Hartland II

Sobha Hartland II is one of Sobha Realty’s most ambitious master-planned communities in Dubai’s Mohammed Bin Rashid City (MBR City), spread over several million square feet and designed for premium lifestyle living.

It includes clusters like Riverside Crescent, Skyscape, and Skyvue, offering a wide variety of apartments and villas with views of the canal, skyline, and natural landscapes.

The project blends urban convenience with green spaces, luxury finishes, and high-end amenities, including swimming pools, gyms, and landscaped parks.

Its central location, near Downtown Dubai, Business Bay, and key transport routes, makes it attractive to both tenants and long-term investors seeking stable rental yields and future capital appreciation.

Sobha One

Sobha One is a premium residential development featuring interconnected towers that rise beautifully in Dubai, designed for luxury living and strong investment potential.

This project offers a mix of 1 to 4-bedroom apartments as well as 3- to 4-bedroom duplexes, combining space, modern design, and upscale finishes. Residents and investors benefit from close proximity to key destinations like Downtown Dubai and major road networks.

Sobha One is known for its high-quality interiors, generous ceiling heights, and large balconies that enhance living comfort.

The development also benefits from Sobha’s signature craftsmanship and attention to detail, making it a solid choice for investors looking for properties with strong rental prospects and long-term value retention.

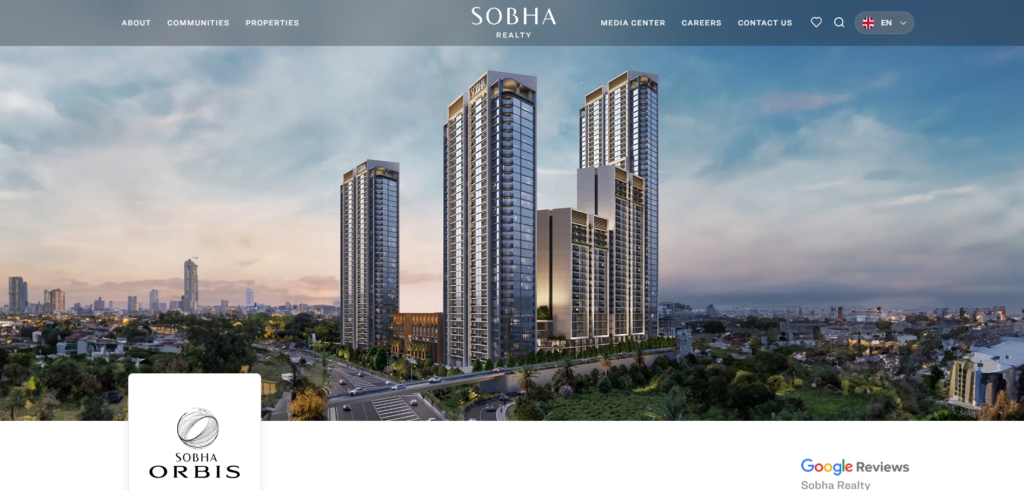

Sobha Orbis – Motor City

Sobha Orbis is a premium residential complex in Motor City, Dubai, featuring beautifully designed apartments across multiple towers.

It offers a range of 1-bedroom apartments, 1.5-bedroom apartments, and 2-bedroom apartments with contemporary layouts, resort-style amenities such as landscaped gardens, a fitness centre, and relaxation spaces, and excellent connectivity to major roads.

Motor City appeals to tenants who seek quieter, community-focused living but still want easy access to urban hubs. The project’s modern architecture and conveniences attract long-term renters, making it a practical choice for yield-oriented investors.

Its pricing entry point and developer credibility make Sobha Orbis a compelling option in Dubai’s mid-market segment.

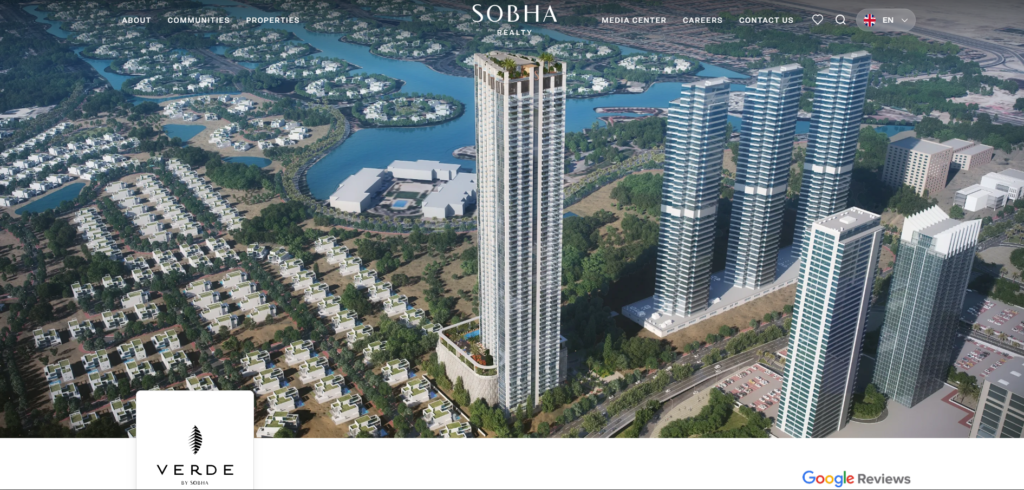

Sobha Verde – Jumeirah Lake Towers

Sobha Verde (also known as Verde by Sobha) is a sought-after luxury residential project located in the heart of Jumeirah Lake Towers (JLT), one of Dubai’s most popular mixed-use districts.

It combines modern living with convenience, offering premium amenities, landscaped spaces, and a strong tenant base due to its proximity to business areas and transportation links.

Verde is designed to provide comfort and quality, featuring sustainable and green building principles. For investors, its central location and consistent rental demand make it an attractive option for achieving stable rental yields and good long-term capital growth in one of Dubai’s most liquid sub-markets.

Financing Your Property Investment in Dubai

Financing plays a crucial role in shaping investment outcomes. Investing in Dubai has become more accessible due to competitive mortgage products and structured developer payment plans. Both residents and non-residents can access financing from local banks, subject to eligibility.

As investors, we should approach financing with discipline. Leverage can enhance returns, but excessive borrowing increases risk. We need to consider interest rates, loan tenure, and cash flow impact before committing.

Sobha-linked payment plans often reduce upfront burden, allowing better capital allocation. A balanced financing strategy improves long-term ROI.

By aligning loan obligations with rental income, investors protect liquidity and avoid stress during market fluctuations. Smart financing supports sustainable growth rather than short-term gains.

Legal Considerations for Foreign Investors in Dubai

Dubai’s legal framework continues to be one of its strongest investment advantages. Freehold ownership zones allow foreign investors full property rights. Escrow regulations protect buyer payments during construction. Transparent title registration systems reduce fraud risks.

For investors, understanding contracts is essential. Sale agreements, service charges, and registration fees directly affect returns. Clear knowledge of exit costs and rental regulations helps with long-term planning.

When investing through Sobha Real Estate, clarity and compliance add another layer of confidence. Dubai’s legal environment supports investor protection, which strengthens the case for Investing in Dubai as a long-term strategy.

The Role of Property Management in Maximizing ROI

From an investor’s point of view, property management plays a direct role in protecting returns and improving long-term profitability. A well-managed property attracts better tenants, reduces vacancy periods, and maintains steady rental income.

In a competitive market like Dubai, professional property management often makes the difference between an average investment and a high-performing one.

Property managers handle critical tasks such as tenant screening, rent collection, lease renewals, and day-to-day maintenance. This ensures that tenants stay longer and properties remain in good condition.

For us as investors, this reduces unexpected expenses and prevents small maintenance issues from becoming costly repairs. Timely upkeep also protects the property’s market value and rental appeal.

Effective property management also helps optimize rental pricing. Managers understand market trends and adjust rents to stay competitive without sacrificing yield.

They also ensure compliance with local regulations, which reduces legal risks. Over time, these factors compound and improve overall ROI.

Instead of seeing property management as an expense, investors should view it as a strategic tool that safeguards income, preserves asset value, and supports sustainable investing in Dubai.

Overview of the Dubai Real Estate Market in 2026

From an investor’s perspective, the Dubai real estate market in 2026 reflects stability, maturity, and long-term growth potential. The market has evolved from rapid price cycles to a more balanced structure driven by genuine demand.

Population growth, business expansion, and investor-friendly visa reforms continue to support consistent housing demand across residential segments.

Supply remains well-managed, especially in prime and established communities. This balance between supply and demand helps control price volatility and protects asset values.

For investors, this creates a predictable environment where rental income and capital appreciation move steadily rather than unpredictably. Mid-income and premium housing segments show strong occupancy levels, supported by expatriates, professionals, and long-term residents.

Government-led infrastructure investments further strengthen market confidence. Transport connectivity, commercial hubs, and lifestyle developments improve liveability and tenant demand.

Transparency in regulations, escrow laws, and digital land registration systems reduces investment risk and builds global trust.

In 2026, Dubai positions itself as a safe and structured real estate market, making it attractive for investors seeking reliable income, capital preservation, and sustainable long-term returns rather than short-term speculation.

Investing in Real Estate: Practical Tips for Investors

- Focus on location fundamentals: Always evaluate connectivity, infrastructure, employment hubs, and future development plans. Locations with strong transport access and lifestyle amenities attract long-term tenants and support steady property appreciation.

- Choose reputed developers: Developer credibility reduces execution risk. Well-established developers deliver better construction quality, timely handovers, and stronger resale value, which directly protects your investment.

- Prioritize rental demand over hype: Avoid chasing short-term trends. Instead, study tenant profiles, occupancy rates, and average rents. Consistent demand ensures stable cash flow and lower vacancy risk.

- Use financing wisely: Leverage can improve returns, but excessive borrowing increases risk. Align loan repayments with rental income and maintain emergency reserves to manage market fluctuations.

- Plan for long-term holding: Real estate rewards patience. Holding quality assets over time allows investors to benefit from rental income and gradual capital appreciation.

- Invest in professional property management: Good management improves tenant retention, reduces maintenance costs, and ensures legal compliance. This directly enhances ROI.

- Diversify your portfolio: Spread investments across locations or property types to reduce exposure to market-specific risks.

- Understand legal and regulatory costs: Account for registration fees, service charges, and taxes early to avoid surprises and protect net returns.

Conclusion (Sobha Real Estate – Investing in Dubai)

From an investor’s perspective, 2026 presents a strong opportunity to build long-term wealth through well-planned real estate investments. Investing in Dubai now feels more structured, transparent, and reliable than ever before.

Stable regulations, controlled supply, and consistent rental demand have transformed Dubai into a mature market that rewards disciplined investors rather than short-term speculators.

Choosing Sobha Real Estate adds another layer of confidence to the investment decision. Sobha’s focus on quality construction, thoughtful planning, and long-term livability aligns well with investor goals such as steady rental income, lower maintenance risk, and strong resale value.

When we combine a reputed developer with the right location, smart financing, and professional property management, we create a balanced investment strategy.

Successful real estate investing is not about timing the market perfectly. It is about understanding fundamentals, managing risk, and thinking long term.

By staying informed and making data-driven decisions, investors can turn Dubai real estate into a dependable asset class. In 2026 and beyond, Investing in Dubai through Sobha Real Estate offers a clear path toward sustainable returns and capital preservation.

Investing in Dubai Properties (FAQs)

Apartments in well-connected communities perform best when investing in Dubai. They offer strong rental demand, easier resale, and lower maintenance compared to villas. Properties near business hubs and metro lines usually deliver better long-term returns.

Key costs include property price, registration fees, agency charges, service charges, and maintenance expenses. Understanding these costs early helps investors calculate net returns accurately when investing in Dubai.

Mid-market properties often perform better for investors due to wider tenant demand and stable yields. When investing in Dubai, balancing affordability and quality usually delivers more consistent returns.

Also read,

- Dubai Real Estate: Guide for Investors and Developers

- Asset Management Company: Dubai Real Estate 2026

- Real Estate Broker Guide: Property Value 2026

- Danube Properties: Dubai Real Estate Investment