Dubai has become one of the most popular places for real estate investment. Over the past twenty years, the city has turned into a global center for business, tourism, and lifestyle. This growth is backed by reliable infrastructure and friendly regulations for investors. From luxury waterfront homes to affordable high-yield apartments, Dubai provides options for both new buyers and experienced investors.

Choosing the right real estate developer is crucial for successful property investment. A reputable developer guarantees good construction quality, on-time project delivery, strong rental demand, and lasting asset value. This blog looks at the five best real estate developers in Dubai. It also explains how to assess a developer, discusses why investing in Dubai is a smart choice, and compares renting with buying in Dubai.

Estimated reading time: 10 minutes

Key Takeaways

- Dubai is a prime location for real estate investment, supported by strong infrastructure and investor-friendly regulations.

- Choosing reputable Real Estate Developers ensures quality, timely completion, and stable rental demand.

- Top developers include Emaar, Meraas, Aldar, Nakheel, and Binghatti, each offering unique strengths and investment opportunities.

- Investors should evaluate developers based on track record, project quality, and post-handover support to enhance investment success.

- Buying property in Dubai typically yields better long-term financial returns than renting, thanks to attractive rental yields and tax benefits.

Dubai Real Estate Developers

Dubai real estate developers significantly shape the city’s global image and investment appeal. They do more than just build structures. They plan communities, develop infrastructure, and create long-lasting lifestyle destinations. Their success in delivering quality projects on time, following regulations, and managing properties after handover affects investor confidence and property value.

Dubai’s top developers adhere to strict regulations, use escrow accounts, and follow international construction and sustainability standards. This approach makes the market relatively secure for both local and foreign investors.

Some of the most influential developers in Dubai include:

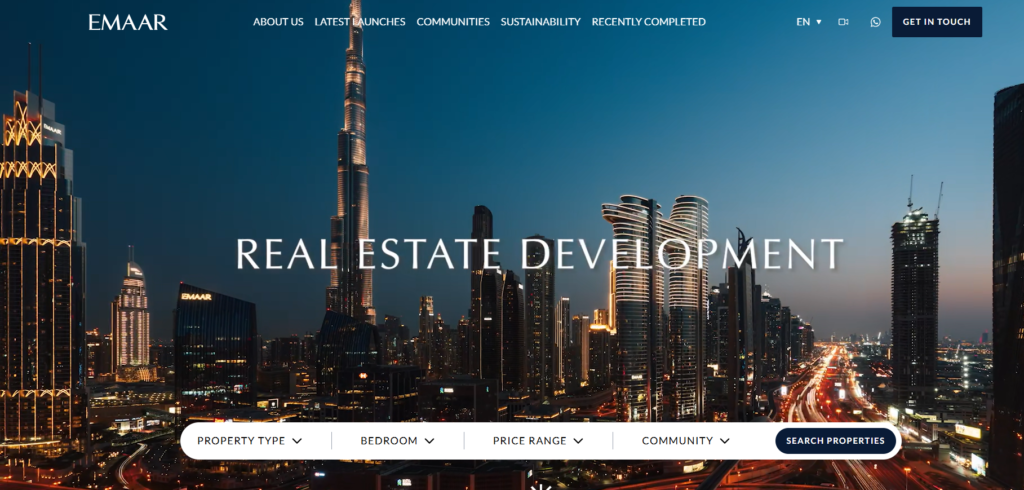

1. Emaar Properties

Emaar Properties is one of the most trusted real estate developers in Dubai. It has significantly shaped the city’s skyline with large-scale developments that include residential, commercial, retail, and leisure spaces. Emaar has a long-term vision that focuses on quality locations, good infrastructure, and consistent design. This approach helps the company keep high demand through different market cycles.

From an investor’s point of view, Emaar properties are low-risk assets thanks to their strong brand reputation and high liquidity. Units developed by Emaar often attract premium tenants, such as professionals, families, and international residents. Rental yields stay stable, and capital appreciation benefits from prime locations and ongoing area improvements. Emaar also has a solid after-sales and community management system that helps protect long-term asset value.

Key strengths of Emaar Properties include:

- Proven track record of timely project delivery

- Prime locations with strong resale demand

- High construction and finishing standards

- Stable rental income and long-term appreciation

Emaar is well suited for investors seeking safety, long-term growth, and consistent returns in Dubai’s real estate market.

2. Meraas

Meraas is known for developing real estate projects that focus on lifestyle and design. These projects combine residential living with retail, hospitality, and entertainment. Unlike traditional developers, Meraas focuses on creating places that draw in residents, tourists, and businesses. Its developments are often situated in busy urban and waterfront areas, increasing foot traffic and rental demand.

For investors, Meraas properties are appealing in the short-term and holiday rental markets. The developer’s emphasis on modern architecture, walkable neighborhoods, and leisure amenities attracts young professionals and international renters. These aspects usually lead to higher rental rates compared to typical residential projects. Meraas projects also benefit from strong branding, which helps maintain resale value in competitive markets.

Key strengths of Meraas include:

- Lifestyle-oriented, mixed-use developments

- High-demand urban and waterfront locations

- Strong short-term rental potential

- Modern design and community planning

Meraas is ideal for investors targeting premium tenants, lifestyle-driven demand, and strong rental performance in central Dubai locations.

3. Aldar Properties

Aldar Properties is a top developer in the UAE known for its focus on sustainability, good governance, and community development. Although Aldar is mainly linked with Abu Dhabi, its growing presence and reputation have drawn investors looking for long-term value and reliable returns. The developer highlights efficient designs, livability, and eco-friendly building practices.

From an investment perspective, Aldar properties attract buyers who want steady rental income instead of speculative profits. Its projects usually appeal to families and long-term residents because of well-planned amenities, open spaces, and strong community management. Aldar also gives significant attention to asset management after a project is finished, which helps keep properties in good condition and supports rental demand over time.

Key strengths of Aldar Properties include:

- Strong governance and financial discipline

- Focus on sustainable and family-oriented communities

- Reliable rental demand from long-term tenants

- Emphasis on lifecycle asset value

Aldar suits conservative investors who prioritize stability, consistent income, and long-term community performance over short-term price movements.

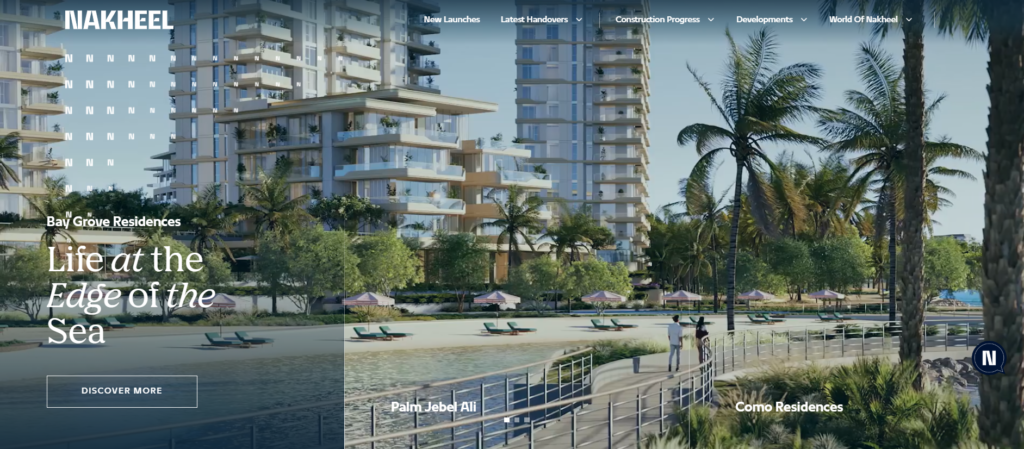

4. Nakheel

Nakheel is one of Dubai’s most famous developers, known for changing the city’s coastline with ambitious waterfront projects. The company focuses on large-scale planning and developments that create self-sustaining communities. Nakheel’s projects often gain strong global recognition, which makes them appealing to international buyers and renters.

For investors, Nakheel properties usually fall into the premium and luxury category. Access to waterfronts, resort-style amenities, and high tourist demand support strong rental values. These projects also see long-term capital growth due to a limited supply of similar locations. Nakheel developments attract both end-users and investors looking for prestigious assets with strong branding.

Key strengths of Nakheel include:

- Iconic waterfront and landmark developments

- Strong appeal to international buyers

- Premium rental and resale potential

- Large-scale master planning expertise

Nakheel is best suited for investors focusing on luxury real estate, long-term appreciation, and high-profile locations within Dubai.

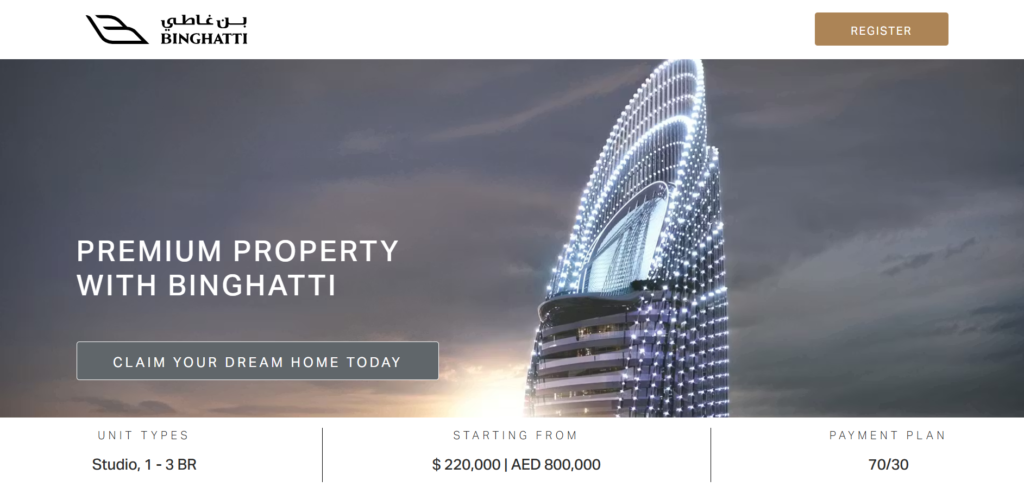

5. Binghatti

Binghatti has quickly become a prominent developer in Dubai by providing unique architectural designs at competitive prices. The company aims to deliver value-driven residential projects for mid-income buyers and rental investors. Binghatti’s developments are usually situated in high-demand urban areas with good connectivity and access to jobs.

Investors often prefer Binghatti due to its lower entry costs and appealing rental returns. The developer focuses on practical layouts, effective use of space, and speedy project completion. These elements help reduce holding risk and allow for faster rental occupancy after handover. Binghatti properties attract many professionals and young families, ensuring a steady demand for tenants.

Key strengths of Binghatti include:

- Competitive pricing and accessible investment entry

- Strong rental yield potential

- Distinctive architectural identity

- Focus on timely delivery

Binghatti is suitable for investors seeking yield-focused opportunities with moderate budgets and strong demand in Dubai’s mid-market segment.

Evaluate Real Estate Developer

Evaluating a real estate developer is an important step before investing in Dubai property. Investors should start by looking at the developer’s history, including completed projects, delivery timelines, and construction quality. A good track record of delivering on time shows operational strength and financial stability. The choice of location is also essential. Reputable developers often select areas with good infrastructure and promising growth.

Clear pricing, payment plans, and escrow compliance show the developer’s credibility and help reduce financial risk. Investors should also consider design quality, layout efficiency, and available amenities, as these factors impact rental demand and resale value. Finally, post-handover services, property management, and community maintenance are vital for protecting long-term asset value. Picking the right developer can greatly enhance investment results in Dubai’s real estate market.

Renting vs Buying in Dubai (Investor Perspective)

From an investor’s perspective, the choice between renting and buying in Dubai relies on long-term financial returns rather than short-term convenience. Renting does not create any asset or financial growth for an investor. While it offers flexibility and a lower initial commitment, rent payments only cover living expenses and provide no access to Dubai’s property appreciation or rental income potential. Rising rental prices can also increase long-term costs without offering ownership benefits.

Buying property in Dubai is a smart investment choice. Ownership enables investors to earn ongoing rental income while benefiting from property value growth over time. Dubai’s real estate market provides attractive rental yields, often higher than many global cities, backed by strong population growth and ongoing infrastructure development. The lack of income tax on rental earnings and capital gains tax further boosts net returns for investors. Additionally, owning property can qualify investors for long-term residency visas, adding non-financial value to the investment.

Although buying requires higher upfront costs like down payments and service charges, these are balanced by long-term cash flow, asset creation, and resale potential. For investors with a medium- to long-term outlook, buying property in Dubai usually offers better financial results compared to renting, especially when investing in projects from well-known developers in sought-after areas.

Why Invest in Dubai

Dubai has become one of the most appealing places in the world for real estate investment. Its strong economy and policies favoring investors attract attention. For investors, the city provides a tax-friendly environment, with no income tax on rental income and no capital gains tax. This situation greatly improves net returns. Compared to many other global cities, Dubai offers high rental yields that usually fall between 6% and 9%. This is fueled by steady demand from professionals, tourists, and expatriates.

The government is heavily investing in infrastructure, transportation, and urban development, which helps property values appreciate over time. Dubai has a clear regulatory framework, escrow accounts, and straightforward ownership laws that protect investors, including those from other countries. Additionally, specific freehold zones let international investors own property fully.

As a global business and tourism center, Dubai experiences steady population growth and ongoing demand for rentals. Investing in property can also lead to eligibility for long-term residency visas, enhancing lifestyle and mobility. These elements make Dubai a stable, high-growth, and competitive real estate market for long-term investors.

Dubai Real Estate Developers (FAQs)

Yes, Dubai real estate developers actively serve foreign investors. Properties are available in specific freehold areas. Ownership laws are clear, and the buying process is open. This makes Dubai one of the most accessible and safe real estate markets in the world.

Dubai developers follow strict government rules that include escrow accounts, project approvals, and clear sales processes. These steps protect buyer funds, monitor construction milestones, and greatly reduce risks from project delays or non-completion.

Also read,

- Dubai Real Estate Guide 2026: Investors, Developers & RERA

- India Real Estate Guide 2026: Laws, Valuation & Investment

- Real Estate Agent Salary 2026: Rewarding or Not

3 thoughts on “5 Best Dubai Real Estate Developers: Invest, Renting vs Buying”