As investors, we always look for markets that balance growth, stability, and long-term demand. Dubai in 2026 checks all these boxes. The city has moved far beyond speculation and short-term hype.

Today, Dubai offers a mature real estate market backed by strong regulations, global connectivity, and a business-friendly environment. Population growth, tourism expansion, and rising corporate activity continue to fuel consistent demand for residential and commercial assets.

Within this landscape, DAMAC Properties holds a powerful position. DAMAC has built its reputation on scale, branding, and lifestyle-focused developments.

As investors, we value developers who understand demand trends and deliver products that attract tenants and buyers year after year. DAMAC does exactly that by combining prime locations, premium amenities, and flexible investment options.

We look at each key project from an investor’s perspective. We also discuss investment opportunities, lifestyle offerings, market conditions, and practical tips to help buyers make informed decisions. If you aim to build wealth through Dubai real estate, this guide gives you clarity and direction.

Estimated reading time: 0 minutes

Key Takeaways

- Dubai’s real estate market in 2026 offers stability, growth, and strong demand driven by population increase and tourism.

- Damac Properties provides diverse investment options, focusing on prime locations and lifestyle amenities that attract tenants.

- Key projects include DAMAC Riverside, DAMAC Heights, DAMAC Valencia, and DAMAC Islands, catering to various investment preferences.

- Investors benefit from rental income stability and potential for capital appreciation across both residential and commercial properties.

- For success, define investment objectives, evaluate locations, and consider diversification to manage risks effectively with Damac Properties.

Key Projects by DAMAC Properties

From an investor’s perspective, DAMAC Properties offers a diverse portfolio that caters to different risk profiles and investment goals.

Its key projects span luxury high-rise towers, master-planned villa communities, waterfront developments, and commercial assets. This diversity allows investors to balance rental income with long-term capital appreciation.

DAMAC focuses on prime locations, lifestyle-driven amenities, and strong branding, which consistently attract tenants and buyers.

DAMAC’s projects continue to benefit from steady demand, flexible investment options, and strong resale potential within Dubai’s mature real estate market.

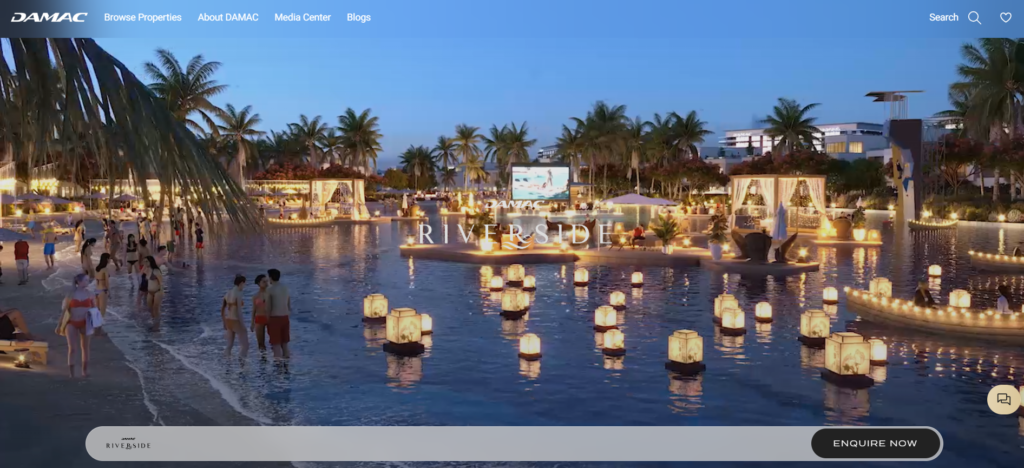

DAMAC Riverside

DAMAC Riverside appeals to investors who focus on long-term tenancy and lifestyle-driven demand. Suburban waterfront communities have gained popularity as residents seek greener surroundings and better work-life balance. DAMAC Riverside aligns perfectly with this shift.

The project emphasizes open spaces, water features, wellness zones, and walkable layouts. These elements attract families and professionals planning long-term stays.

From an investor’s viewpoint, this translates into lower tenant turnover and reduced vacancy risk. Long-term tenants also reduce leasing and maintenance costs over time.

Entry prices at DAMAC Riverside remain relatively moderate compared to prime central locations. This improves affordability and enhances rental yield potential.

Infrastructure expansion around the area continues to improve accessibility, which supports future capital appreciation. Investors who prefer stable growth, predictable income, and lower volatility will find DAMAC Riverside well-suited to a balanced investment strategy in 2026.

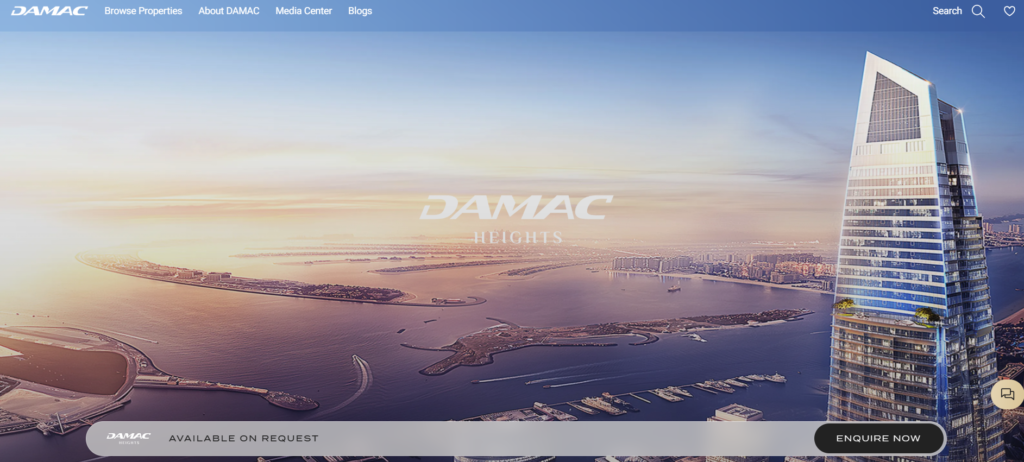

DAMAC Heights

DAMAC Heights remains one of the most recognisable luxury towers in Dubai Marina. For investors, location remains the strongest driver of performance, and Dubai Marina consistently ranks among the city’s top rental zones.

The area attracts professionals, entrepreneurs, and tourists, creating year-round demand for both short-term and long-term rentals.

DAMAC Heights offers high-end apartments with sea-facing views, premium finishes, and strong building amenities. These features allow investors to command higher rents compared to standard residential towers.

Limited availability of new luxury high-rises in Dubai Marina also supports price stability and appreciation. This scarcity factor plays an important role in protecting long-term value.

From an income perspective, investors benefit from flexible rental strategies. Units perform well on holiday rental platforms as well as traditional annual leases. This flexibility improves yield optimization. For investors seeking stable cash flow, strong resale potential, and exposure to a prime waterfront location.

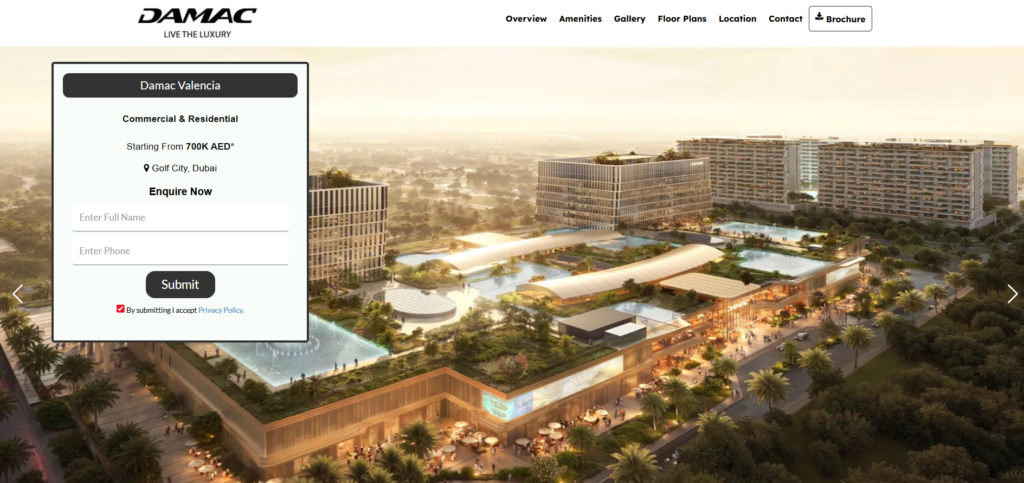

DAMAC Valencia

DAMAC Valencia targets the growing demand for villas and low-density living in Dubai. Over the past few years, investor interest in villa communities has increased due to limited supply and rising end-user preference. DAMAC Valencia benefits directly from this trend.

From an investment standpoint, villas provide land-backed value, which often leads to stronger long-term appreciation.

DAMAC Valencia offers Mediterranean-inspired architecture, landscaped streets, and community amenities that appeal to families and high-income tenants. These factors support stable rental demand throughout market cycles.

Rental yields in villa communities remain attractive, especially for long-term leases. Tenants often commit to multi-year stays, which enhances income stability.

Maintenance costs remain manageable due to structured community management. For investors who prioritize capital preservation, steady appreciation, and reduced exposure to market fluctuations, DAMAC Valencia represents a solid investment choice in Dubai’s 2026 real estate landscape.

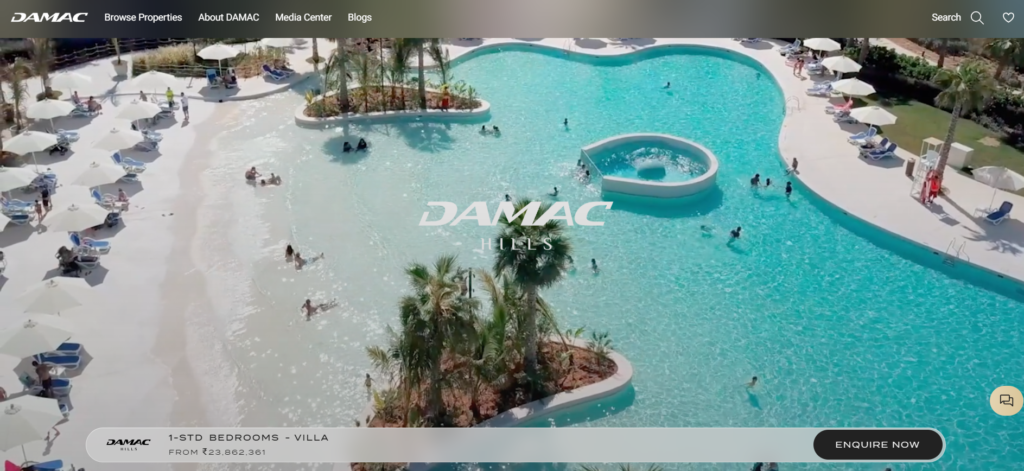

DAMAC Hills 1

DAMAC Hills stands as one of DAMAC’s most established developments. From an investor’s perspective, maturity reduces risk. DAMAC Hills 1 offers a complete ecosystem that includes villas, townhouses, apartments, schools, healthcare facilities, retail outlets, and leisure spaces.

This diversity allows investors to select units based on budget and target tenant profiles. Families, professionals, and executives all find the community attractive.

As a result, rental demand remains consistent across different property types. Golf course access and extensive green spaces further enhance lifestyle appeal.

Resale liquidity also remains strong due to the project’s reputation and proven performance. Investors benefit from transparent service charges and well-managed common areas. For those seeking dependable rental income, lower uncertainty, and long-term stability

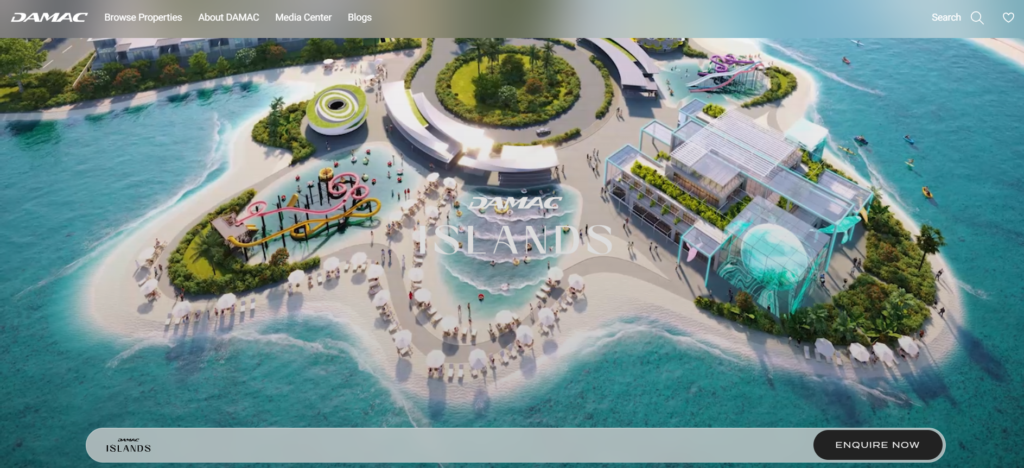

DAMAC Islands

DAMAC Islands represents DAMAC’s entry into ultra-luxury island living. From an investor’s point of view, such developments function best as long-term capital appreciation assets. Waterfront and island properties consistently attract global high-net-worth buyers.

DAMAC Islands focuses on exclusivity, privacy, and premium design. Limited supply strengthens pricing power and protects value over time. International investors often treat these properties as prestige assets rather than purely income-generating units.

While rental yields may vary depending on usage, the primary appeal lies in appreciation and wealth preservation. As Dubai’s luxury market continues to expand, demand for unique island developments is expected to grow.

Investors with higher capital and a long-term outlook can benefit significantly from exposure to DAMAC Islands.

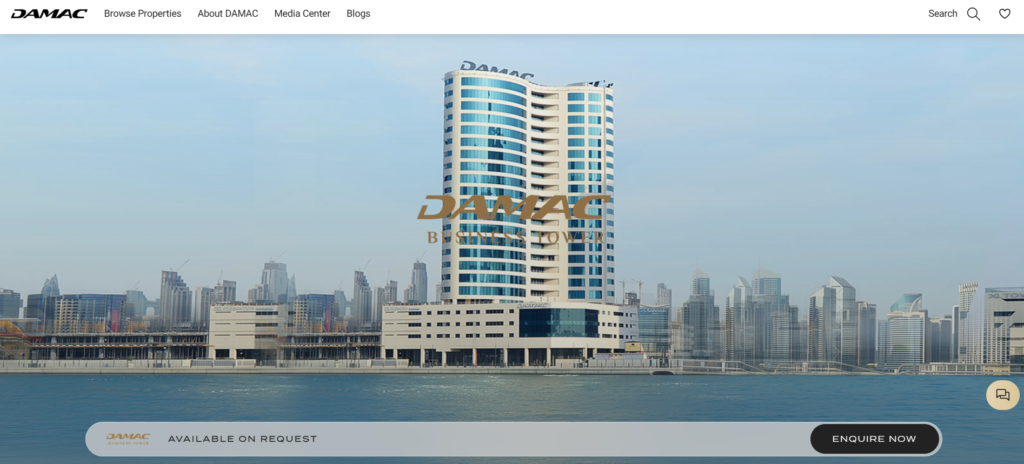

DAMAC Business Tower

DAMAC Business Tower offers investors exposure to Dubai’s commercial real estate segment. Located in Business Bay, the tower benefits from proximity to major corporate zones and transport links. Business activity in Dubai continues to grow, driving demand for quality office spaces.

Commercial properties provide longer lease tenures compared to residential units. This creates predictable income streams and reduces tenant turnover. DAMAC Business Tower appeals to small and mid-sized enterprises seeking premium addresses at competitive rates.

For investors, adding commercial assets improves portfolio diversification and reduces dependence on residential rental cycles.

Investment Opportunities with DAMAC

DAMAC Properties offers flexible and well-structured investment opportunities that suit both new and experienced buyers. One of the key advantages lies in DAMAC’s off-plan projects.

These developments often come with competitive entry prices and extended payment plans, which reduce upfront capital pressure and improve cash flow management. Early investors also benefit from price appreciation during the construction phase.

For investors seeking immediate returns, DAMAC’s ready-to-move-in properties provide stable rental income from day one. These units are located in high-demand areas, which supports strong occupancy rates and consistent yields.

DAMAC’s brand recognition further enhances resale demand, particularly among international investors, reducing exit risk.

DAMAC also enables portfolio diversification by offering residential, villa, luxury waterfront, and commercial properties. This variety allows investors to spread risk across different market segments.

Amenities and Lifestyle Offerings

Amenities play a major role in driving rental demand, tenant retention, and long-term property value. DAMAC Properties focuses strongly on lifestyle-led developments, which gives its projects a competitive edge in Dubai’s real estate market. Key amenities and lifestyle offerings include:

- Branded Living Concepts: DAMAC frequently collaborates with global luxury brands to create premium interiors, which help investors achieve higher rental rates and stronger resale appeal.

- Golf Course Communities: Developments like DAMAC Hills feature championship golf courses that attract high-income tenants and long-term residents, improving rental stability.

- Wellness and Fitness Facilities: Modern gyms, yoga zones, jogging tracks, and wellness spaces support healthy lifestyles and increase tenant satisfaction.

- Green Spaces and Landscaped Areas: Parks, gardens, and open spaces enhance livability and appeal to families, which often leads to longer tenancy periods.

- Retail and Dining Zones: Integrated retail outlets, cafes, and restaurants create self-sufficient communities, reducing tenant dependency on external amenities.

- Waterfront and Leisure Features: Many DAMAC projects offer waterfront views, beach-style pools, and leisure decks, allowing investors to command premium rents.

- Security and Community Management: Gated access, 24/7 security, and professional maintenance services protect asset value and reduce investor risk.

Together, these amenities enhance lifestyle appeal, support consistent occupancy, and strengthen long-term investment performance.

Overview of Dubai’s Real Estate Market

Dubai’s real estate market in 2026 reflects maturity, resilience, and investor confidence. From an investor’s perspective, the market benefits from strong regulatory frameworks, transparent property registration systems, and clear ownership rights for foreign buyers.

These factors reduce risk and create a secure environment for long-term capital deployment.

Demand continues to rise due to population growth, skilled migration, and long-term residency programs that encourage professionals and entrepreneurs to settle in the city.

Tourism also remains a key driver, supporting short-term rentals and boosting occupancy rates in prime locations. On the supply side, authorities maintain better control over new launches, which helps prevent oversupply and supports price stability.

Rental yields in Dubai remain attractive when compared to major global cities, making the market appealing to income-focused investors.

Infrastructure investments, including transport networks and commercial hubs, further enhance property values. In 2026, Dubai offers a balanced real estate environment where investors can achieve steady rental income, capital appreciation, and portfolio diversification with reduced volatility.

Why Invest in Dubai

From an investor’s perspective, Dubai offers a rare combination of stability, growth, and global accessibility. The city follows investor-friendly policies, including full foreign ownership in designated areas and a tax-efficient environment with no annual property tax. These factors directly improve net investment returns.

Dubai’s strategic location connects major global markets, attracting multinational companies, entrepreneurs, and skilled professionals.

This constant inflow of people creates sustained demand for residential and commercial properties. Long-term visa programs linked to property ownership further strengthen investor confidence and support long-term holding strategies.

The government continues to invest heavily in infrastructure, tourism, and business development, which enhances property values over time. Compared to other global cities, Dubai still offers competitive entry prices and strong rental yields.

For investors seeking income, capital appreciation, and long-term security, Dubai remains a highly attractive real estate destination.

Tips for Potential Buyers and Investors

From an investor’s point of view, success in Dubai’s real estate market depends on clear planning and informed decision-making. The first step is to define your investment objective.

Some investors focus on rental income, while others prioritise long-term capital appreciation. Your goal should guide the choice of location, property type, and budget.

Location remains a critical factor. Properties in well-connected areas with strong infrastructure and amenities usually perform better in terms of occupancy and resale value. Investors should also study the target tenant profile, such as families, professionals, or short-term renters, to align the property with market demand.

It is important to evaluate service charges, maintenance costs, and community management quality, as these directly affect net returns. Reviewing payment plans and financing options helps manage cash flow efficiently. For off-plan investments, investors should assess the developer’s track record and project timelines.

Diversification also plays a key role in risk management. Spreading investments across residential and commercial assets can improve portfolio stability. Finally, working with trusted real estate advisors and staying updated on regulations ensures smarter, more secure investment decisions in Dubai.

Damac Real Estate Developers (Conclusion)

From an investor’s perspective, Dubai in 2026 offers a rare blend of market stability, growth potential, and global appeal. Strong regulations, controlled supply, and continuous economic expansion create a secure environment for long-term real estate investment.

Within this landscape, developers like DAMAC provide diversified opportunities across luxury residences, villas, waterfront projects, and commercial assets.

For investors, the key advantage lies in flexibility. Dubai allows strategies focused on rental income, capital appreciation, or a balanced combination of both. Lifestyle-driven developments, strong infrastructure, and sustained population growth continue to support demand across market segments.

However, smart investing requires clarity of goals, careful property selection, and a long-term outlook. By focusing on location, quality, and demand trends, investors can reduce risk and improve returns.

Overall, Dubai remains a compelling destination for building wealth through real estate in 2026 and beyond.

Damac Real Estate Developer (FAQs)

Investors prefer DAMAC Properties due to its strong brand value, large-scale developments, premium locations, and lifestyle-driven communities that support rental demand and long-term capital appreciation.

Yes, DAMAC properties usually have good resale liquidity due to brand recognition and strong demand from local and international buyers.

Investors should review location, service charges, payment plans, developer track record, and exit strategy. Proper due diligence ensures better returns and reduced investment risk.

Also read,

- Real Estate Companies in Dubai: Best 5 in 2026

- Danube Properties: Dubai Developer